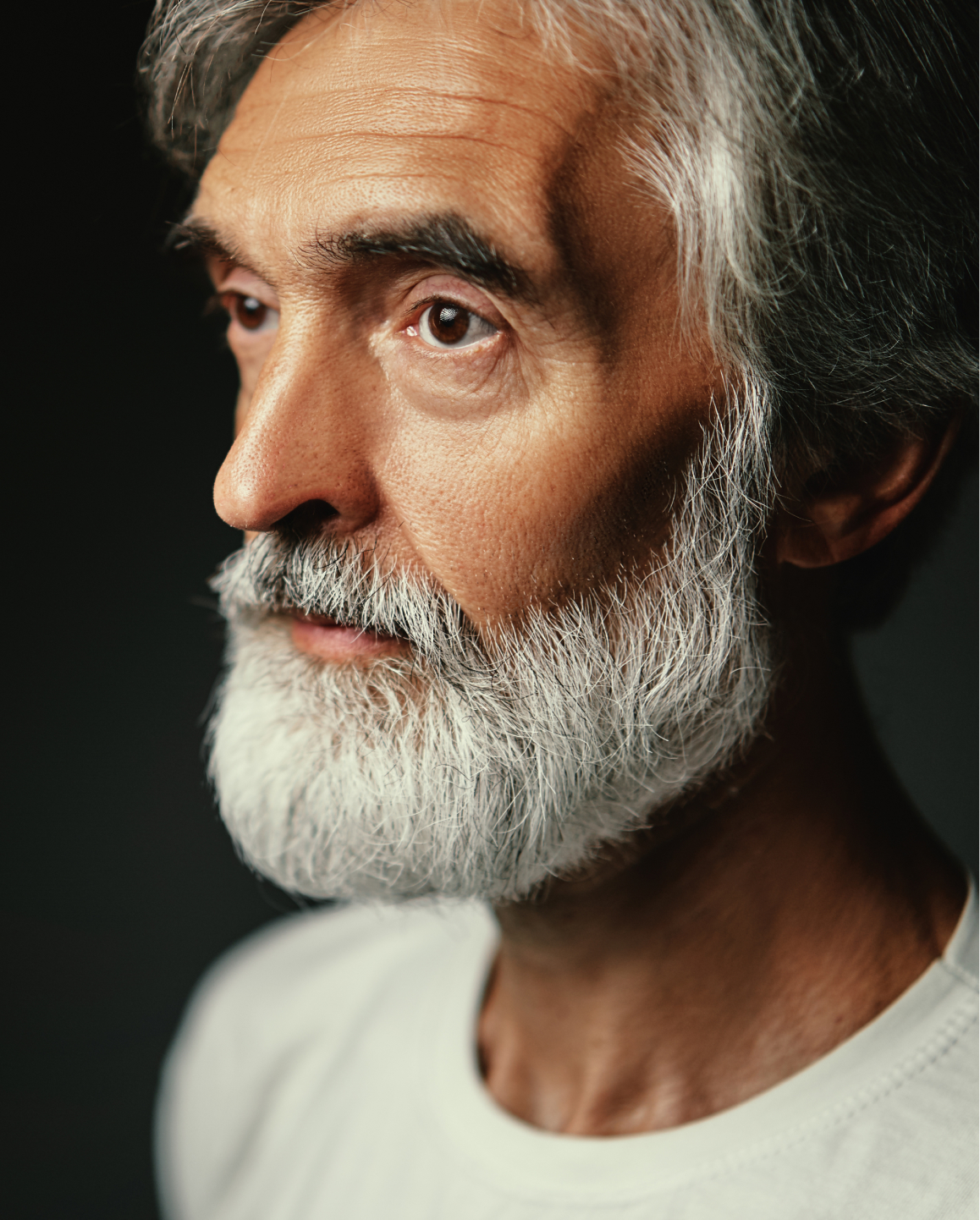

Ian’s story.

Approaching Retirement.

IAN, 65

Reviewing my pension options

My current situation

I am 65 and married, my wife is 5 years younger than me. I would like to retire in two years when I am eligible for the state pension.

As a warehouse operative I earn £25,000 a year. I have some credit card debt. I do not have any savings, but I do have a modest pension pot. I do not use salary exchange for pension contributions.

I have recently paid off my mortgage. I would like to understand my options at retirement.

My goals

- Short Term – understand how to manage debt and clear it before retirement.

- Medium Term – understand how to access my pension and small pots.

- Long Term – live a happy retirement.

What I need

I would benefit from one-on-one help from an adviser to understand how I can maximise my pension pot at retirement.

I would like to explore the possibility of continuing to work part time until my wife reaches retirement age.

I would also benefit from advice regarding my debt and how to clear it before I retire.