11 April 2018

This month, your pension contributions will automatically go up – so what does this increase mean for you? Whatever your situation, there are four things to know about 2018’s pension contribution increase. These tips will help you to make the most out of this change in legislation.

1. If you currently overpay on your pension, nothing will change

If you currently contribute the minimum 1% to your pension, April’s pension contribution increase means you should now pay 3%. However, if you currently contribute 3% or more, you won’t have to pay any more.

It’s worth noting that revised pension contribution limits mean that you can overpay your pension by up to £40,000 per year tax-free (or up to £1,030,000 in a lifetime). Therefore, this one of the most cost-effective and tax-efficient ways to save for your future. Speak to a Corinthian pension consultant to find out how to make the most of pension tax relief.

2. Your employer’s pension contribution will increase too

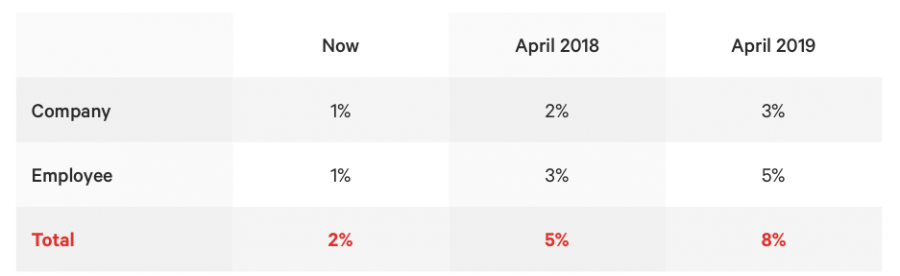

Unless your employer currently contributes 2% or more to your workplace pension scheme, the new legislation doubles what they have to pay. It will go from 1% to 2% of your pensionable pay.

This will bring your total minimum contribution from you and your employer combined from 2% to 5%. This, as you can imagine, will have a significant impact on your final pension pot.

3. There are even more pension contribution increases to come

From April 2019, you and your employer can expect to pay even more into your pension, bringing overall contributions to 8%.

Your employer must increase their contribution from 2% to 3%. And you will have to pay a minimum of 5% into your workplace pension.

The table below offers a helpful breakdown of these changes:

4. Making pension contributions via Salary Sacrifice could save you money

If these scheduled pension contribution increases worry you, there is a solution. These mandated pension increases could be rendered barely noticeable if you make your contributions via Salary Sacrifice.

Salary Sacrifice – or Salary Exchange – enables employees to make their pension contributions from their pre-taxed pay – increasing your overall net income. This means that you’ll pay less tax and National Insurance which will compensate for the increase in your pension contributions.

Salary Sacrifice can provide significant savings for employers too. They can save around £1,500 per annum for just 12 members (each with an average salary of £30,000 paying 3% with a 13.8% NI saving). You can do this by engaging with a specialist pension and benefits consultant like Corinthian.

For more advice about pension increases or to find out how much money you can save, speak to a Corinthian consultant today.