30 May 2018

Gone are the days when providing a company pension indicated a forward-thinking, benevolent employer.

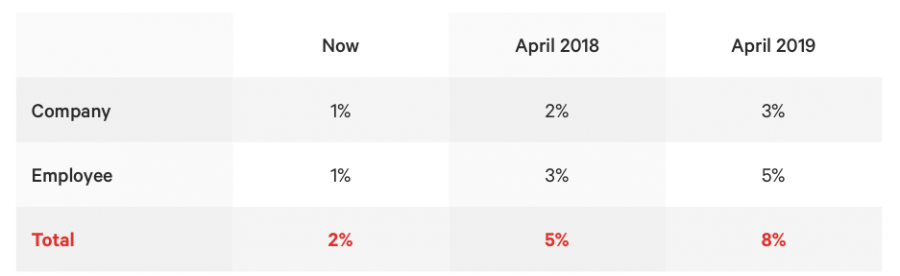

The new tax year marks more than five years since auto-enrolment was introduced. The compulsory minimum contribution by employers into workplace pensions has now increased to 2% of earnings. This will rise to 3% in April 2019. Research by the Institute for Fiscal Studies (IFS) shows the number of employees in the private sector with workplace pensions more than doubled between April 2012 (32%) and April 2018 (67%). The IFS state that this was a direct result of the introduction of auto-enrolment. According to the Pensions Regulator (tPR), auto-enrolment saw 9 million people joining a workplace pension by the end of 2017.

Today, with pensions an integrated part of employment, the progressive employer is much more likely to offer employee benefits and services to staff, a decision which can be mutually rewarding in a number of ways. In addition to offering expert pension advice, Corinthian’s specialist team of employee benefits consultants can create a comprehensive Employee Benefits Package, tailored to the specific requirements of your business, from our extensive range of company benefits. With over 25 years’ experience in helping SMEs with their workplace pensions and benefit schemes, Corinthian offers extensive knowledge and guidance in these areas.

Here we answer some of the most frequent questions asked by employers…

What other benefits can I offer my employees?

The options available to the employer looking to create a benefits package for employees include:

- Private Medical Insurance

- Dental Plan

- Health Cash Plans

- Group Income Protection

- Gym membership

- Total Reward Statements

- Voluntary benefits

- Share incentive plans

- Relevant Life Assurance

- Group Life Assurance

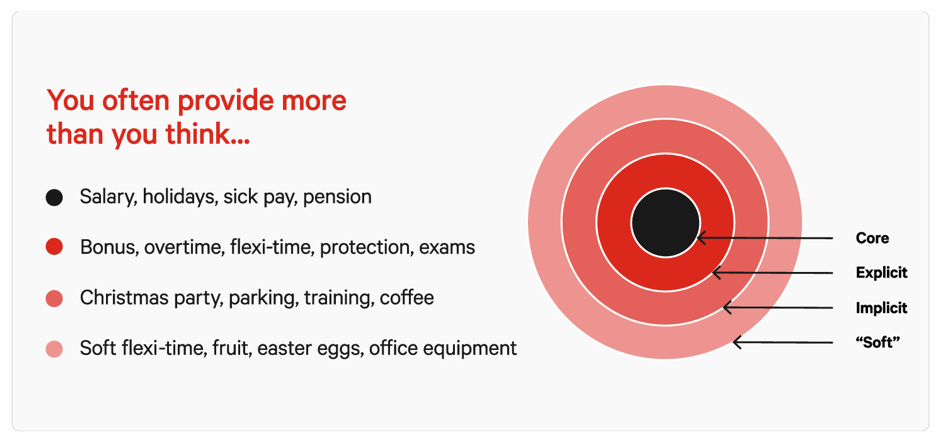

From allowing dogs at work to flexible working, employee benefits can include anything that your employees might value.

Developed with SMEs in mind, Corinthian offers the Total Rewards Portal, a flexible complete benefits and management solution. Featuring a comprehensive administration area where data can be uploaded, reports generated and employee records viewed, edited or personalised. The portal delivers a highly effective means of managing data, people, holiday and other absences. In addition, the Total Rewards Statements generated by the portal provides employees with a summary of the overall value of their financial rewards, including base pay, incentives and employee benefits. This not only educates employees about their benefits but helps them understand the value of them.

HR Magazine states that when an employee benefits package, such as the Total Rewards Portal, is implemented alongside other benefits such as flexible working, support for parental leave and other family-related policies, it provides a powerful mix for managing skills and talent in an organisation.

What are the advantages of providing employee benefits?

In providing company benefits, a business proactively nurtures its relationship with employees, consequently reinforcing brand identity within the workforce. When staff identify with their organisation, they’re more likely to feel a sense of belonging and loyalty to the business. This results in a workforce that is easier to motivate and contributes more to the smooth running of your organisation.

Provision of employee benefits programs can also offer some financial savings e.g. employer NI contributions decrease under salary exchange schemes. However, arguably the most important factor to consider is how employee retention improves when employees receive more than standard pensions.

Why is employee retention important?

High employee turnover can be bad for business, creating unease within the organisation, affecting staff morale and depleting businesses of time and money in recruiting replacements. Conversely, investing in employee retention can offer a return over and above the financial savings of employing and training new staff.

Those gains include:

- Increased productivity – happy staff stay longer and are more productive, doing a better job for your business.

- Corporate identity – experienced employees work better in the ways and style of your business, and they are better able to promote it.

- Culture – positivity is contagious, resulting in less conflict in the workplace. An ethos of support and encouragement leads colleagues to help each other succeed.

- Customer relationships – that ethos filters through to those you are in business for, creating satisfied, loyal customers who want to continue doing business with you.

If you want to find out how your business can take advantage of these gains and more, speak to a Corinthian consultant today.